Seamless integration of an acquired fund manager’s investment operations and trading functions

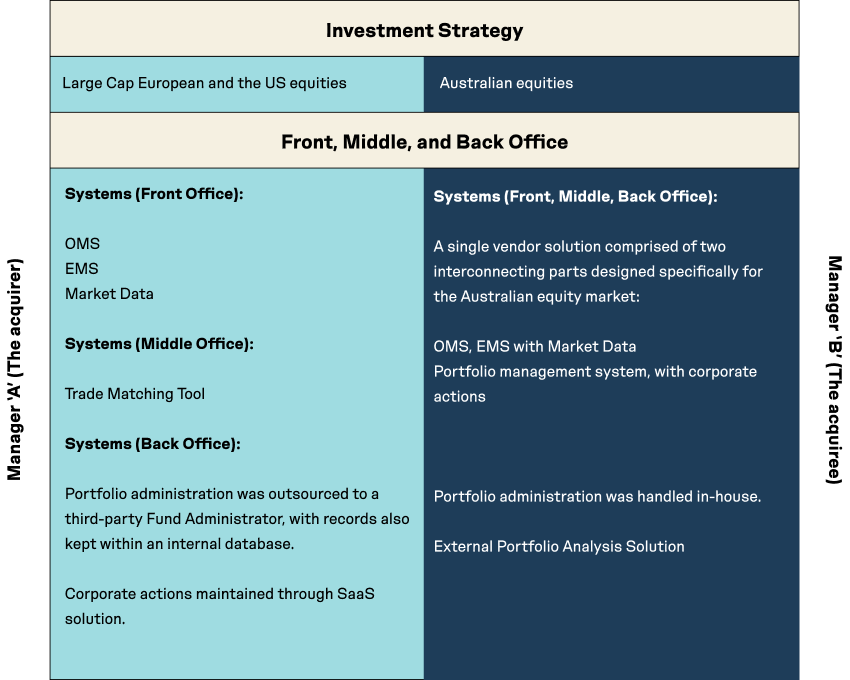

When Manager ‘A’ acquired Manager ‘B,’ my role was to merge Manager ‘B’s investment operations and trading with Manager ‘A’s. Manager ‘A,’ traded globally, focusing mainly on Large Cap European and the US equities. Manager ‘B’ traded exclusively in Australian equities.

Background

Both companies had well-established trading and operations functions that catered efficiently for their business requirements.

However, post-acquisition, maintaining two separate but similar environments would be inefficient and risky on all the following fronts – financial, resourcing, risk management, transparency, consistency and continuity, scalability, and administrative.

The challenge

I needed to evaluate both fund managers’ mechanisms and identify the best options for merging – different systems and mechanisms designed for different markets.

Manager ‘A’s funds under management and their number of portfolios managed were ten times larger than Manager ‘B’s. Regardless of this difference, we needed to maintain seam- less functionality for the Australian equity strategy alongside the Global strategy without ‘the tail wagging the dog.’

Eight key challenges to creating a single, shared environment

Front Office:

- Manager ‘A’s’ trading was executed during the Australian night when the US and European markets were open. Their existing workflows weren’t designed to cater to the real-time demands of the ASX trading day

- Trading teams would remain separate, so the OMS functionality needed to stay segregated with each team’s portfolios, brokers, and trades visible only to them

- Manager ‘B’s’ brokers were served by a different EMS infrastructure

Middle Office:

- Manager ‘B’ used different trade matching software and connected with brokers and custodians differently

Back Office:

- Manager ‘B’ performed all portfolio administration in-house, whereas Manager ‘A’ outsourced the administration to an independent third party

- Manager ‘B’ managed their corporate actions within their single vendor solution, whereas Manager ‘A’ employed an independent SaaS solution

- Manager ‘A’ stored all portfolio data within an internal database, where Manager ‘B’ stored everything within their single vendor application

- Manager ‘B’ maintained an external Portfolio Analysis Solution which was not part of Manager ‘A’s business processes

What we did

Our goals were to:

- maintain robust process integrity for end-to-end stakeholders

- incorporate the new Australian equity investment strategy into Manager ‘A’s

- avoid duplicating tasks unnecessarily

We set an ambitious project timeline of six months and focused on minimising disruption in the front, middle and back offices.

Favouring long term results over quick fixes

We prioritised long-term results over ‘quick fix’ operational changes likely to yield superficial efficiencies. We decided to do the heavy lifting to lay solid foundations for future growth and consolidation, including:

- Doing a ‘root and branch’ review of all existing workflows. We adjusted some current ones. We also created new ones with timing constraints that ensured there were no impediments throughout the ASX trading day

- Working with Manager ‘A’s OMS provider to establish a segregated view within the existing environment and new same-day workflows to facilitate the Australian equity trading strategy

- Establishing new OMS and EMS connections with over twenty brokers used by Manager ‘B’

- Creating a separate interface for Manager ‘A’s’ Trade Matching Tool – to connect Manager ‘B’s brokers and custodians and for each of the onboarded portfolios

- Outsourcing portfolio administration for all new portfolios, with new same-day workflows to facilitate the Australian equity trading strategy

- Onboarding new Manager ‘B’ portfolios to Manager ‘A’s’ SaaS solution for corporate actions

- Establishing SWIFT connectivity with custodians for corporate action notifications and elections to and from SaaS solution

- Setting up data flows – OMS, Clients, Portfolio Managers, Fund Administrators, Custodians, etc. – to and from the in-house database to accommodate the new portfolios and their requirements

- Creating a new data flow from Manager ‘A’s’ OMS to the external Portfolio Analysis Solution

The Result

Consolidating everything in one environment would ultimately be best for everyone. But we had to get there without adversely affecting either manager’s operations.

It was crucial to understand Manager ‘A’s environment before absorbing Manager ‘B’s trading and investment operations.

Only then could we begin to explore how best to integrate the two.

We managed near-total integration of Manager ‘B’s’ trading and investment operations into the Manager ‘As’ existing environment apart from:

- Keeping a tiny part of Manager ‘B’s’ single vendor solution for tracking orders in the market

- Choosing a new service provider for the portfolio analysis tool and established new workflows accordingly

- After exploring numerous scenarios for merging and moving forward, we envisaged our ideal result and worked back from there.